866-325-1278

Customer Service

Account Login/Enroll

All Participants and Eligible Employees Must Register as New Users.

To register enter your social security number with no dashes as username and your Date of Birth as your password. (Example: 01011900)

STOP! If you are a MADISON or OKEECHOBEE employee, please do not proceed. To Open an account, stay on the Vista 401(k) homepage and select “401(k) Plan” across the top in blue. Next choose “Forms” from the drop down. Here you will find a fillable form for your district. Please follow the directions on the form to sign up for this plan. All others may proceed.”

My Account Login

All Participants and Eligible Employees Must Register as New Users.

To register enter your social security number with no dashes as username and your Date of Birth as your password. (Example: 01011900)

STOP! If you are a MADISON or OKEECHOBEE employee, please do not proceed. To Open an account, stay on the Vista 401(k) homepage and select “401(k) Plan” across the top in blue. Next choose “Forms” from the drop down. Here you will find a fillable form for your district. Please follow the directions on the form to sign up for this plan. All others may proceed.”

Vista 401(k) Plan

FAQ

How does Vista 401(k) work?

Contributions to the plan are made through regular payroll deductions; selections from 21 mutual funds are available; no taxes are paid on any contributions or earnings until they are withdrawn. Upon withdrawal ordinary income tax rates will apply. The Vista 401(k) Plan is specifically designed to help you save for retirement. During your working years you make tax-deferred contributions, which can be invested in one or more of the available funds. Taxes remain deferred on your contributions, earnings or any capital appreciation until you withdraw your money from the plan. The plan saves you money because your per-pay-period contributions reduce your taxable income.

Who can join?

All full-time and part-time employees of the participating Employer Sponsors are eligible to participate in the Vista 401(k) Supplemental Retirement Plan

How much may I contribute?

The maximum you can contribute to your account is limited by federal tax law. The annual limit is $23,000. If you are 50 years old or older you can contribute another $7,500 for a total of $30,000.

Can I change my contribution amount?

What happens if I discontinue contributions?

When can I receive my plan money?

Can I withdraw from my 401(k) account like my savings account?

Can I borrow from my plan account?

Your 401(k) plan has a loan provision to give you access to your money. There are certain rules that apply:

- You must have a minimum of $2000 in your account.

- You can borrow up to 50% of your account balance, with a maximum of $50,000.

- Minimum loan amount is $1000.

- You have up to 5 years to repay the loan.

- Only one loan is permitted at a time. There is also a (30) day waiting period to acquire a new loan after paying off an existing loan

- The interest rate will be 2% over Prime, however repayment of both principal and interest is re-deposited into your account.

- There is a $85 loan processing fee.

How am I taxed on my plan money?

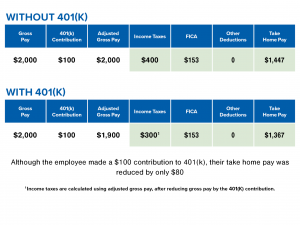

The money you contribute to your 401(k) is not taxed until you receive a distribution from your plan. In other words, contributing to the 401(k) reduces your income taxes by reducing your taxable income. With Vista 401(k), contributions are deducted before income tax is calculated. The charts below illustrate the tax savings for an employee earning $2000 per pay period, income taxes of 20% based on deductions, 7.65% FICA tax , and a contribution of $100 per pay period (shown in the WITH 401(k) chart).

Is there a time when I must receive payments from the plan?

Yes, just like IRAs or other retirement plans, you must begin receiving payments starting with the year after the year in which you achieve age 73.

Do I have a choice of plan investment options?

What is a mutual fund?

How do I get additional information or enroll in Vista 401(k)?

You may request an Enrollment Form or get additional information by calling the Retirement Services Team at 1-866-325-1278 (M-F, 8 a.m.- 5 p.m.). You may also visit the Vista401k.com homepage and click on the “Account Login/Enroll” box at the top of the page.”

Mail your completed form to Vista 401(k) at P.O. Box 1878, Tallahassee, Florida, 32302-1878.

Simply complete the form indicating:

- The per pay period amount you want to contribute.

- How you want your money invested.

- The beneficiary who will receive your account in the event of your death.

Does Vista 401(k) have representatives onsite at school locations?

What are the qualifications for taking a loan from my Vista 401(k) Account?

How can I pay off my loan early?

To pay off your loan please mail a personal check, cashier check or money order payable to “Newport Trust FBO: Vista 401(k).” In the memo field place [your name] and account # A11684. Mail this payment to the address below:

Vista 401(k)

P.O. Box 1878,

Tallahassee, Florida 32302.

I am about to receive a DROP payout. Can I rollover some or all of the money into my 401(k) Plan?

When I retire, do I have to take a lump-sum payout of my 401(k) account?

Can I rollover my other 401(k) or 403(b) account(s) into my Vista 401(k) account?

You can rollover your other previous employer’s 401(k) and 403(b) accounts at any time. You may rollover current employer 403(b) accounts into your Vista 401(k) account as long as you meet certain IRS requirements:

- You are over the age of 59 ½ OR

- No longer working for the plan sponsor of your 403(b) account

Rolling over funds to your 401(k) account may be a good way to cut expenses and keep more of your returns.

I am almost 73 or older. Do I need to take action to receive my Required Minimum Distribution (RMD)?

No, this is not required. The Vista 401(k) Plan automatically calculates your RMD amount and sends out a check to the address on file. Contact our office to update your contact information if needed.

Note: If you remain employed, you are not obligated to start taking your RMD at 73 years of age.

How can I reset my account password?

I will be out of school soon for the summer. Do I need to stop contributions to my 401(k) account?

When will I receive an account statement?

Participant statements are posted to your account online after each quarter. If you wish to receive a hard copy you must visit your account online and change the option from paperless. If you have any questions please contact the Retirement Services Department at (866) 325-1278.

I designated a beneficiary when I signed up for benefits with the School District. Does that apply to my 401(k) account?

I took a hardship from my account. Do my contributions have to stop?

Home | About Us | 401(k) Plan |401(k) Funds | Learning Center | Blog | Contact Us

P.O. Box 1878 Tallahassee, Florida 32302-1878

866-325-1278